Alternative Data Regressor: V1

A Python Program to attain a linear regression of some alternative data against financial asset prices . A CSV file is the input. The output is the regression results.

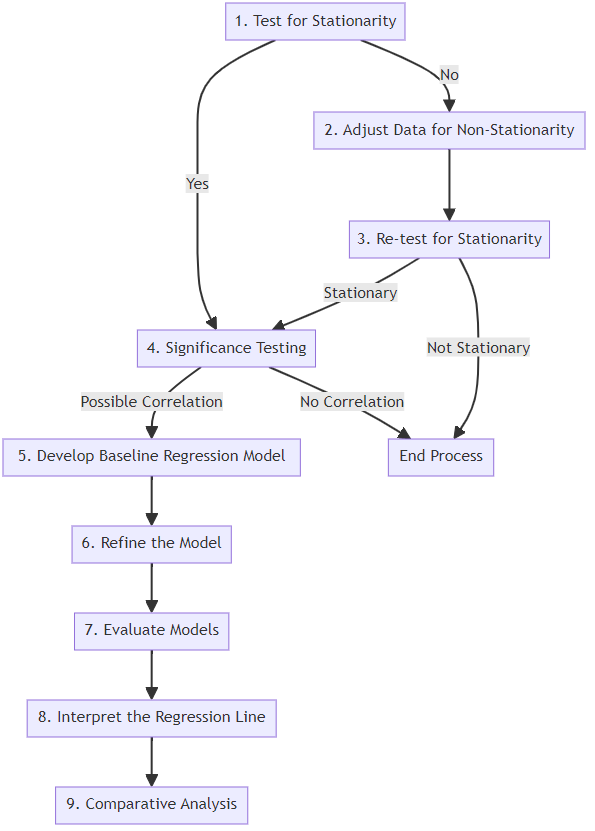

The provided Python program is designed to process time series data from a CSV file and execute a series of analytical steps based on a predefined decision tree. Key functionalities include:

Reading a CSV File: The user inputs the path to a CSV file, which the program reads into a DataFrame.

Stationarity Testing: It tests the time series data for stationarity using the Augmented Dickey-Fuller test.

Adjusting for Non-Stationarity: If the data is non-stationary, it applies a log transformation to stabilize the time series.

Re-testing for Stationarity: After transformation, it retests the data for stationarity.

Significance Testing: Conducts an Ordinary Least Squares (OLS) regression to test the significance of the relationship between the time series and a dependent variable.

Model Development and Evaluation: If a significant relationship is found, the program proceeds to develop a baseline regression model, which is then refined and evaluated based on its R-squared value.

Output: The program outputs the results of the stationarity tests, significance tests, and the R-squared value of the regression model.

import pandas as pd

import numpy as np

from statsmodels.tsa.stattools import adfuller

from statsmodels.regression.linear_model import OLS

import statsmodels.api as sm

from scipy import stats

import matplotlib.pyplot as plt

from sklearn.model_selection import train_test_split

from sklearn.metrics import r2_score

def test_stationarity(timeseries):

# Perform Dickey-Fuller test:

dftest = adfuller(timeseries, autolag='AIC')

return dftest[1] # p-value

def adjust_non_stationarity(data):

# Adjusting for non-stationarity (example: log transformation)

return np.log(data)

def significance_testing(X, y):

# Perform significance testing (example: OLS regression)

X = sm.add_constant(X) # adding a constant

model = OLS(y, X).fit()

return model.pvalues

def main():

# Load data

file_path = input("Enter the path to your CSV file: ")

df = pd.read_csv(file_path)

# Assuming the time series column is named 'timeseries'

timeseries = df['timeseries']

# Step 1: Test for Stationarity

if test_stationarity(timeseries) > 0.05:

# Step 2: Adjust Data for Non-Stationarity

timeseries = adjust_non_stationarity(timeseries)

# Step 3: Re-test for Stationarity

if test_stationarity(timeseries) > 0.05:

print("Data is still non-stationary after transformation. Ending process.")

return

else:

print("Data is stationary after transformation. Proceeding with analysis.")

else:

print("Data is stationary. Proceeding with analysis.")

# Step 4: Significance Testing

# Assuming another column 'dependent_var' as the dependent variable

pvalues = significance_testing(df[['timeseries']], df['dependent_var'])

if any(pval < 0.05 for pval in pvalues[1:]): # Ignoring the constant's p-value

print("Significant correlation found. Proceeding to model development.")

else:

print("No significant correlation found. Ending process.")

return

# Steps 5, 6, 7: Develop, Refine, and Evaluate Regression Model

# This is a simplified example using OLS regression

X_train, X_test, y_train, y_test = train_test_split(df[['timeseries']], df['dependent_var'], test_size=0.2, random_state=0)

model = OLS(y_train, sm.add_constant(X_train)).fit()

predictions = model.predict(sm.add_constant(X_test))

print("Model R-squared:", r2_score(y_test, predictions))

# Step 8: Interpret the Regression Line

# This step is more analytical and depends on the specific model and data

# Step 9: Comparative Analysis

if __name__ == "__main__":

main()